Lebanon's banking sector and local currency are strong despite political and security challenges on the national and regional levels, as the Central Bank retains sufficient foreign asset reserves, economic experts told Al-Mashareq.

Banks are achieving a growth rate of 5% to 6%, which has led their foreign currency reserves to reach a combined total of $45 billion.

The Lebanese pound "is very fortified because foreign currency reserves in banks rose in the span of six months from $42 billion to $45 billion", economist Ghazi Wazni told Al-Mashareq.

Similarly, Lebanon's foreign currency liabilities -- totaling $4.5 billion annually -- are covered for 2018, he added.

The banking sector has achieved growth in 2018 ranging between 5% and 6%, compared to less than 3% in 2017, said Wazni.

Remittances from Lebanese expatriates also increased from $7.5 billion to $8 billion so far this year, he added.

The growth achieved by banks "finances the needs of the state and the economy", said Wazni, adding that the formation of the government will be a further catalyst for stability and economic recovery.

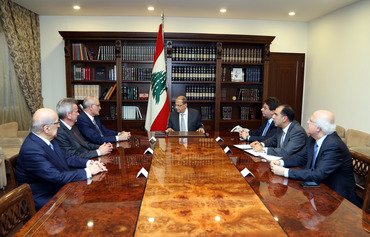

Lebanon has been without a government since after the country’s parliamentary elections on May 6th due to the failure of rival parties to agree on the government formation, including the distribution of cabinet positions.

'Iron fist'

The monetary policy adopted by Lebanon's Central Bank is based on securing sufficient foreign asset reserves and ensuring monetary stability in terms of both the interest rate and exchange rate of the pound, economist Jassim Ajaka told Al-Mashareq.

In addition to $45 billion in hard currency, the foreign asset reserves include $12 billion in gold and $12 billion in assets denominated in the US dollar in Lebanese banks abroad, he said.

"It is technically impossible for the Lebanese pound to collapse."

Central Bank governor Riad Salameh "runs the banking sector with an iron fist and will not allow its collapse", Ajaka said.

But he warned that the delay in forming a government disrupts the implementation of the provisions of the CEDRE 1 conference, "which was the economy’s only chance of salvation from the recession and dire state of public finances", he said.

International donors at the CEDRE 1 conference on April 6th pledged $11 billion in concessional loans and grants to support Lebanon's investment plan, provided it forges ahead with a raft of reforms.

These include reducing the budget deficit, combating corruption and curbing waste in the public sector.

Impact of regional conflicts

Lebanon "is experiencing a political crisis, not an economic or monetary one", said Violette Ghazal al-Balaa, editor-in-chief of Arab Economic News.

"Since 2011, the Lebanese economy has been impacted by the war in Syria and its repercussions inside Lebanon, whereas the economy was besieged by a series of factors that are not conducive to growth," she told Al-Mashareq.

And yet, despite the instability that plagues the region, the overall growth rate in Lebanon over the past five years has been stable between 1% and 1.5%, and is even expected to rise to 2% this year, she said.

Lebanon's production sector, however, is suffering from a crisis that only "real internal stability" can help resolve, she said.

That is why forming "a national consensus government capable of implementing the provisions of CEDRE 1" will bring in economic relief and help create steady growth that is commensurate with Lebanon's capabilities, she said.

![Lebanon's Central Bank in Beirut has been successful in overcoming the challenges posed by the country's turbulent political arena. [Nohad Topalian/Al-Mashareq]](/cnmi_am/images/2018/08/08/13847-Lebanon-Beirut-bank-600_384.jpg)