The Arab banking sector has been adhering to US sanctions on all designated individuals, companies and groups, banking officials from across the region told Al-Mashareq.

The Central Bank of Lebanon (BDL) has issued new directives that spell out its commitment to implementing sanctions related to anti-money laundering and combating the financing of terrorism (AML/CFT).

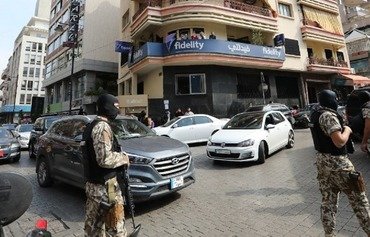

Speaking at the Arab Banking Conference on April 23rd, BDL governor Riad Salameh emphasized that Lebanon's existing laws and BDL directives already address issues related to terror financing and money laundering.

These ensure Lebanon is compliance with AML/CFT requirements, he said.

During regular reviews of the banks, the BDL's Special Investigation Commission assesses the banks' compliance with these laws and directives, he said.

The commission also reviews the extent to which Lebanese banks have enhanced their information systems to combat illegal funds, and has found there is a high level of compliance on the part of the banks, Salameh said.

Compliance with international standards

"The banking sector’s priority is to maintain the confidence of depositors, borrowers and shareholders," Byblos Bank Group chief economist Nassib Ghobril told Al-Mashareq.

The banking sector considers the financial costs of compliance with domestic and international banking standards, such as transparency in investment, as worthy expenditures "to avoid any risk to its reputation or performance", he said.

"The banks welcome the various directives issued by the BDL because their implementation keeps the sector in compliance with international standards and safeguards it against volatility and instability," he said.

The directives related to AML/CFT laws and tax information exchange laws are "necessary to maintain confidence in the sector and its reputation and compliance with international standards and laws", Ghobril said.

Directives related to implementing the Basel Standards on liquidity and solvency requirements also "reflect the banking sector's compliance with international standards and enhance the confidence of international parties", he added.

The Basel Standards are an internationally agreed set of measures developed by the Basel Committee on Banking Supervision that aim to strengthen the regulation, supervision and risk management of banks.

Lebanese compliance with international banking directives and standards in turn helps to strengthen relations with correspondent banks and foreign and Arab institutions, Ghobril said.

Lebanon's banking sector "has taken several preventive measures" to combat terror financing and money laundering, he said.

"It will not allow itself to be a transit point or haven for illegal funds or funds of individuals or institutions that are under international sanctions," he added."This reassures depositors that their money in Lebanese banks is safe from any risk."

Egypt, Kuwait committed to US sanctions

Egypt is "fully committed" to the implementation of all US sanctions related to terror financing and money laundering, Central Bank of Egypt (CBE) deputy governor Jamal Najm told Al-Mashareq.

Egypt also has been co-operating with other countries in the region to enforce anti-terrorism measures of various kinds, he said.

The CBE periodically receives updates on guidelines issued by the Middle East and North Africa Financial Action Task Force (MENAFATF), Najm said.

This is because "we are part of a team that assesses the commitment of countries to combating terrorism and money laundering", he said.

Egypt is part of a global system to combat terrorism and money laundering, he added, stressing that as such the CBE "adheres to all related international sanctions and laws".

Kuwait Banks Union chairman Adel al-Majid meanwhile offered assurances that Kuwaiti banks "are in full compliance with the US lists of designated individuals, groups and companies".

"Our commitment to implementing the sanctions imposed on Iran and its affiliates in the region does not pose challenges," told Al-Mashareq.

![Lebanon Central Bank governor Riad Salameh says Lebanese banks have been adhering to US sanctions on all designated individuals, companies and groups. [Photo courtesy of Lebanon's Central Bank]](/cnmi_am/images/2019/05/22/18162-Lebanon-Central-Bank-600_384.jpg)