The Central Bank of Lebanon (BDL) now requires that non-banking institutions (money transfer companies) receiving electronic money transfers from abroad pay out these remittances in Lebanese pounds only.

The ruling, which appears in Circular No. 514 (Decision No. 12978) of January 14th, will help to control the money supply in the market, and seal loopholes in the financial sector that can be exploited for money laundering, experts said.

Western Union, MoneyGram and OMT money transfer companies are among those affected by the decision, and have said they are committed to compliance.

OMT will start taking the necessary measures to implement the decision at no additional cost to the sender, according to its general manager, Toufic Moawad.

![Money transfer companies such as MoneyGram must now pay out electronic transfers from abroad in Lebanese pounds only. [Nohad Topalian/Al-Mashareq]](/cnmi_am/images/2019/02/04/16447-Money-Gram-company-600_384.jpg)

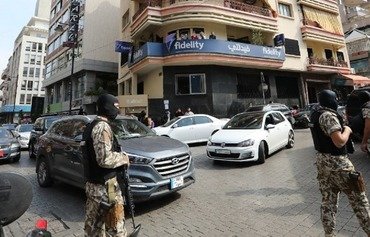

Money transfer companies such as MoneyGram must now pay out electronic transfers from abroad in Lebanese pounds only. [Nohad Topalian/Al-Mashareq]

Combating money laundering

The Central Bank's decision is part of "Lebanon's long-standing commitment to combat money laundering", economist Jassim Ajaka told Al-Mashareq.

This commitment dates back to 2001, when Anti-Money Laundering Law No. 318 was ratified, he said. It was amended in 2015 by Law No. 44 on Fighting Money Laundering and Terrorism Financing.

BDL's latest decision "aims to strengthen Lebanon’s position with regard to its anti-money laundering laws", he said.

"This decision stipulates that non-banking institutions (money transfer companies) must pay electronic money transfers they receive from abroad in Lebanese pounds only," he said.

The decision, which subjects money transfer companies to Central Bank monitoring, was added to basic circular No. 69/2000, which is addressed to all institutions that conduct electronic financial and banking transactions, he said.

"First and foremost, this allows for greater oversight over the concerned companies through the statements they submit to BDL," he said.

"It also puts a stop to the purchase of contraband with hard currency, or smuggling these funds in cash across borders (Law No. 42/2015)," he said.

Foreign currency reserves

The decision "aims primarily to increase local liquidity in the US dollar, which has been in increasing demand as a result of the pressure on the Lebanese pound", economist Violette Ghazal al-Balaa told Al-Mashareq.

The decision was issued "after the level of anxiety soared in the wake of the statements made by Finance Minister Ali Hassan Khalil [which suggested] that a restructuring of Lebanon’s public debt was forthcoming", she said.

This necessitated a national position, articulated by President Michel Aoun, "affirming Lebanon’s commitment to meet its debt obligations on schedule without dipping into bank deposits", she said.

"The decision primarily aims to build up BDL’s [foreign currency] reserves, which dropped from about $44 billion to about $40 billion in the past two months," al-Balaa said.

"BDL is working to shore up its foreign currency reserves", she added, and claims it is able to cover 80% of the liquidity with the Lebanese pound.

In other words, she explained, "it is able to meet all requests for conversion from the dollar to the Lebanese pound".

Regulating banking sector

The Central Bank's decision is a continuation of a number of previous actions, said Tony Farah, economic editor at al-Joumhouriya newspaper.

The decision serves two purposes, he told Al-Mashareq: to control the money supply in the market and attempt to prevent outflow of hard currency; and to seal loopholes in the financial sector that can be exploited for money laundering.

Money transfer and currency exchange companies are known to be the weak link in money laundering prevention, he said.

To address this, he added, BDL has issued several circulars aimed at regulating the banking sector, in line with internationally adopted standards.

"The decision requiring that [electronic] money transfers be paid in Lebanese currency comes in the context of better monitoring of funds that enter Lebanon through money transfer companies," Farah said.

![The Central Bank of Lebanon now requires money transfer companies to pay out all electronic transfers received from abroad in Lebanese pounds. [Nohad Topalian/Al-Mashareq]](/cnmi_am/images/2019/02/04/16446-Lebanese-bank-transfers-600_384.jpg)